Are cabins a good investment?

When it comes to escaping the hustle and bustle of city life, cabins offer a charming retreat in nature. Many cabin enthusiasts not only seek the joy of cabin living but also wonder whether cabins are a smart financial investment.

In this blog post, we’ll explore the factors that make cabins a good investment from both a financial and lifestyle perspective.

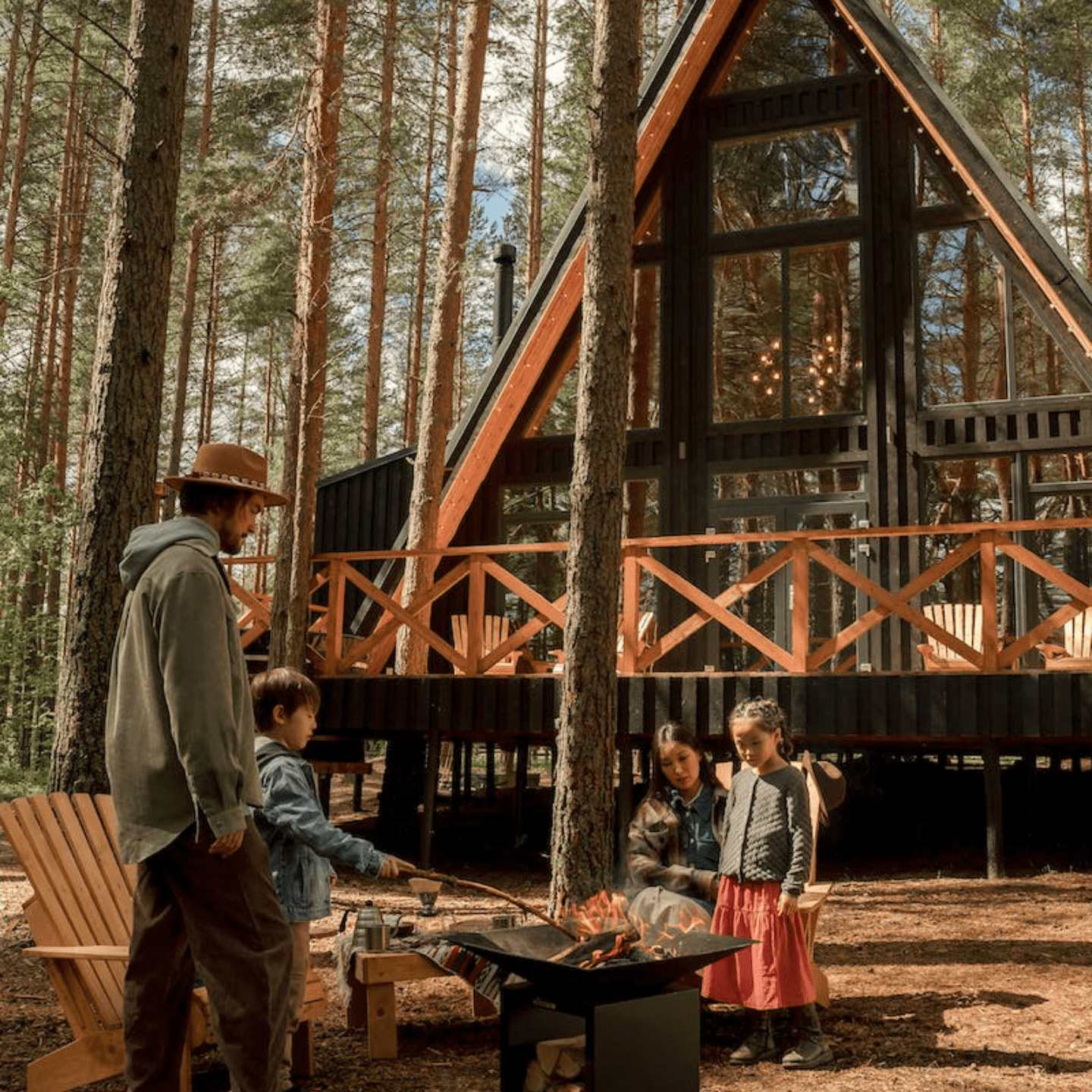

1. The Allure of Cabin Living

Before diving into the investment aspect, let’s take a moment to understand the allure of cabin living. Cabins provide an escape from the stresses of daily life, allowing individuals and families to reconnect with nature and unwind. The tranquil surroundings, fresh air, and proximity to outdoor activities make cabins an attractive lifestyle choice for many.

2. Rising Popularity of Cabin Rentals

One of the main factors contributing to the appeal of cabins as an investment is their popularity as vacation rentals. In recent years, the demand for unique and immersive travel experiences has surged. Leading more travelers to seek out cozy cabins over traditional hotels. Cabin rentals offer a sense of privacy and intimacy that hotels cannot match. So, this makes them highly sought after in the tourism market.

3. Steady Rental Income Potential

As an investment property, cabins can generate steady rental income throughout the year, especially if located in popular vacation destinations or near recreational areas. Many cabin owners find that their properties are booked well in advance, providing a consistent source of revenue. This dependable cash flow can make cabins an enticing option for those looking to diversify their investment portfolio.

4. Appreciation of Cabin Properties

Beyond rental income, the value of well-maintained cabins tends to appreciate over time. As more people discover the joys of cabin living, the demand for these properties increases, which can positively impact their market value. Also, certain areas with limited cabin availability may experience even more substantial appreciation, making cabins not only a place to adore and call home but also a valuable asset.

5. Tax Benefits and Considerations

Investing in a cabin can also offer various tax benefits, depending on the location and usage of the property. In some regions, certain tax deductions may be applicable for expenses related to maintaining and managing the rental property. Potential cabin investors need to consult with a tax professional to understand the specific tax implications based on their circumstances.

6. Diversification of Investment Portfolio

For people with a diversified investment strategy, adding a cabin property to the mix can bring several advantages. Real estate investments like cabins often behave differently than traditional stocks or bonds, providing a hedge against market fluctuations. By diversifying into cabin properties, investors can spread risk and potentially enjoy more consistent returns.

To Review

All in all, cabins can be a great investment for those seeking both financial returns and a refreshing lifestyle. The rising popularity of cabin rentals, the potential for steady rental income, property appreciation, tax benefits, and the diversification of an investment portfolio all contribute to the appeal of cabin ownership.

Whether you’re looking for a tranquil retreat for personal use or an income-generating asset, investing in a cabin can be a rewarding venture. However, as with any investment, thorough research, careful planning, and an understanding of the local real estate market are essential for making a sound decision.

So, if you’ve ever dreamt of having your cabin getaway, now may be the perfect time to turn that dream into a wise investment. Happy cabin hunting!

Leave a Reply